The 2020 calendar year is already well underway and to date there have been a number of significant tax updates in Cambodia. Of note has been the implentation of the 2020 Law on Financial Management and the introduction of a new Prakas on Tax on Income which came into effect from 29 January 2020. There have also been a number of other regulations passed since 1 January 2020 dealing with issues such as tax invoices, the calculation of Specific Tax, the implementation of tax incentives for SME’s and updates to the progressive tax rates of small taxpayers and tax resident employees.

These updates have kept us all busy as we understand how they may affect our clients and over the next few weeks we will go through them in more detail through a series of client updates starting with main updates included in the Law on Financial Management and the progressive tax rates.

2020 Law on Financial Management

(Royal Kram NS/RKM/1219/025 – dated 20 December 2019

Each year the Royal Government of Cambodia promulgates a Law on Financial Management which sets out changes to the Law on Taxation (LoT) for the forthcoming financial year. The 2020 Law on Financial Management (LoFM), as in previous years, contained a number of updates to the LoT which we will discuss in more detail below.

Additional Tax on Dividend Distribution

Additional Tax on Dividend Distribution (ADDT) was a mechanism that was set out under the LoT to ensure that dividend distributions made by a Cambodian company were subjected to the appropriate Tax on Income rate. Typically most dividend distributions made by a Cambodian company would come from retained earnings after Tax on Income has been declared and paid however in some circumstances such as when a Qualified Investment Project (QIP) distributed dividends from retained earnings derived during a Tax on Income holiday period the ADDT mechanism was used to ensure that Tax on Income was paid at the time of the dividend distribution.

More recently the implementation of Prakas 372 in early 2019 expanded the scope of a dividend distribution made by a Cambodian entity for tax purposes to include retained earnings and year to date earnings relating to a share transfer has in turn expanded the application of ADDT.

The revisions made by the LoFM relating to ADDT include:

- Additional Tax on Dividend Distribution is now referred to as Advance Tax on Dividend Distribution,

- QIP entities that distribute dividends to their shareholders whilst in their Tax on Income holiday period will not be subject to the Advance Tax on Dividend Distribution from 1 January 2020,

- Advance Tax on Dividend Distribution when paid to the tax authority will result in a tax credit which can be utilized in the taxpayers Annual Tax on Income declaration for the tax year in which the Advance Tax on Dividend Distribution was declared and paid.

- If the Advance Tax on Dividend Distribution is higher then the Annual Tax on Income liability in the Annual Tax on Income declaration the excess tax credit can be carried forward.

- Advance Tax on Dividend Distribution applies equally to the repatriation of profits by Cambodia Branches of a Overseas Principal insofar as the Advance Tax would apply to the repatriation of taxable income by a Branch if that distribution had not yet been subject to the applicable Tax on Income rate in Cambodia.

- It should also be noted that repatriation of taxable income by a Cambodia Branch to its overseas principal would be considered as income from business activities carried out by a non-resident through a permanent establishment under Article 33(10) of the Law on Taxation and as such subject to withholding tax of 14%

DFDL Comments:

As its name suggests the Advance Tax on Dividend Distribution brings forward the date that Tax on Income applies to certain transactions but allows a tax credit for the tax paid at the time the transactions occurred in the taxpayers Annual Tax on Income declaration. This would typically be applied when a taxpayer distributes a interim dividend from current year earnings that have not been taxed or if there is a change of shareholding in a Cambodian company that has untaxed earnings on hand at the time of the share transfer.

The recently released Prakas Tax on Income No. 098 dated 29 Jan 2020 provides an example of how Advance Tax on Dividend Distribution would work with respect to a taxpayer distributing a interim dividend from untaxed year to date earnings as follows:

Example:

In October 2020, an enterprise distributes year to date income of KHR 40,000,000 (approximately USD1,000) to its shareholders. The enterprise must declare and pay the Advance Tax on Dividend Distributions in its October 2020 monthly tax return as per below:

To establish the Gross Dividend (inclusive of Tax on Income) the formula would be as follows:

Dividend Received/[(1-(20/100*(TOI Rate)]

Step 1 – Determine the dividend amount before tax = Dividend received/0.8

40,000,000/0.8= 50,000,000 KHR

Step 2- Apply the Advance Tax on Dividend Distribution to the Gross Dividend

50,000,000 KHR *20% (Tax on Income Rate)

Advance Tax on Dividend Distribution payable = 10,000,000 KHR (approximately USD2,500)

When the enterprise prepares its Annual Tax on Income declaration for the 2020 tax year it would record the Advance Tax on Dividend Distribution of USD2,500 as a tax credit to offset against its taxable income for the year.

As noted above the other most common example when Advance Tax on Income would apply would be with respect to a transfer of shares in a Cambodian company which has retained earnings or year to date earnings that have not yet been subject to Tax on Income. Under Prakas 372 retained earnings including year to date untaxed earnings that relate to the transfer of shares in a Cambodia company would be treated as a dividend for tax purposes meaning that much like the interim dividend scenario outlined above Tax on Income would need to be paid at the time of the share transfer via the Advance Tax on Dividend Distribution mechanism.

The Advance Tax on Dividend Distribution would be declared in the monthly tax returns of the taxpayer for the month in which the interim dividend is distributed or share transfer effected.

Of course the major point to come out of the LoFM changes regarding the Advance Tax on Dividend Distribution is the update that provided a QIP distributes dividends during its Tax on Income holiday period then the Advance Tax on Dividend Distribution will not apply. This is a very significant update as the issue experienced by a number QIP’s in Cambodia to date was around trapped cash as there was very little incentive to repatriate profit via a dividend distribution in the knowledge that both Tax on Income and withholding tax would be triggered by the distribution.

Prior to the LoFM the Tax on Income holiday for QIP’s only acted as a deferment of the Tax on Income meaning that it would be clawed back at the time a QIP distributed the taxable income it had received during its tax holiday period to its shareholders. Now it is clear that from 1 January 2020 that provided a QIP is still in its Tax on Income holiday period it will not have the Tax on Income clawed back on its dividend distributions to shareholders – this amounts to a permanent exemption of Tax on Income which would be welcomed by all QIP’s operating in Cambodia.

What is slightly more unclear is whether the exemption from the Advance Tax on Dividend Distribution will apply to retained earnings of a QIP that were made prior to 1 January 2020 which are then distributed after 1 January 2020 when the QIP is still in its Tax on Income holiday period. This point still needs to be clarified by the GDT.

Progressive Tax Rates

The LoFM also provides that the progressive Tax on Income rates for physical persons and the monthly Tax on Salary rates for employees can now be set by the Ministry of Economy and Finance through a Sub-Decree giving the Ministry more flexibility with respect to how and when it sets these rates.

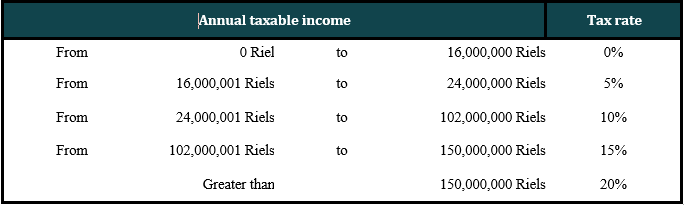

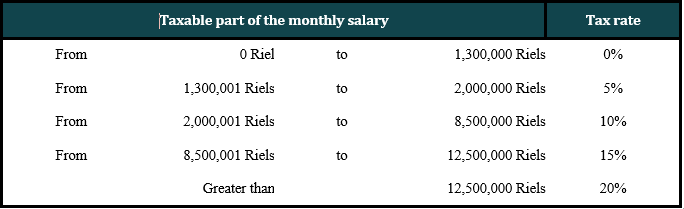

Sub-Decree No. 09 dated 13 February 2020 provides the tables of taxable thresholds for the Annual Progressive Tax on Income rates for physical persons and the taxable threshold of the monthly tax on salary rates for tax resident employees in Cambodia as outlined below:

Progressive Tax on Income rates for physical persons

Monthly Progressive Tax on Salary rates for resident employees

We note the bottom threshold of the monthly tax on salary rates for salary that is subject to 0% has increased from 0 Riel to 1,300,000 Riel (approximately USD325). Currently the bottom threshold of the monthly tax on salary rates subject to 0% is 0 Riel to 1,200,000 (approximately USD300).

The GDT will shortly issue a Prakas with respect to the implementation date of the Sub-Decree.

This article was written by DFDL.